The Supplier Enablement team here in Procurement is responsible for adding and updating supplier entries in our Peoplesoft ERP system for Gateway, Design & Construction, research Subawards, and the LIbrary ALMA system.

Contact us with any questions: purchasing@bfs.ucsb.edu

Download the UCSB Business Information Form.

Please visit our ServiceNow catalog to add new suppliers. A quote, invoice, contract, or some other document from the supplier will be required to assist our team with adding the correct supplier.

There are several suppliers that are populated on the backend system of Jaggaer, but have never been requested or activated by UCSB.

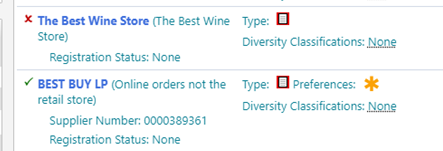

If the supplier's name is written in ALL CAPS and has a Supplier Number (as shown below), then they are either an active UCSB supplier, or were once and have been inactivated for various reasons. You might be able to request a re-activation by sending us a request to gatewayhelp@bfs.ucsb.edu.

If, however, the supplier's name is *not* in all caps (see below), this vendor has never been active for UCSB in Gateway and you will need to submit a brand new Add Supplier request.

A common misconception is that suppliers active in Gateway are 'pre-approved'. The process our team goes through to add a supplier into Gateway is extensive, but aims to gather business information (such as Tax ID/W9, remittance and fulfillment addresses, and business type), but we do not collect insurance up front or ask the supplier to agree to UC's terms and conditions. The reason for this is because every transaction is unique, and has different requirements.

- UCSB is not exempt from sales tax, except when items are purchased as property using federal funds where the title to that property vests with the Federal Government or for resale (where sales tax is collected on the final sale, such as for the Bookstore).

- For most purchases made out-of-state, the State of California will assess a sales tax (called a "use tax"). Therefore, all purchases shall have applicable sales tax applied to their order.

- California also allows a "Partial Sales tax Exemption" for research and development equipment valued over $5k. The rate is currently 3.81%. For eligibility and process questions, please contact Ron Hirst in Accounts Payable, or view the CA BOE's website: www.cdtfa.ca.gov/industry/manufacturing-exemptions.htm

It is the University's policy to separate an employee's University and private interests, and to safeguard the University and its employees against charges of favoritism in the purchase of goods and services. Purchase of goods or services from any officer or employee of the University or from a near relative of any officer or employee is strictly prohibited unless the employee's position entails teaching or research duties.

Only local suppliers who will take a purchase order are added to the Walk-In form. If you have a local supplier you need to walk into, the FlexCard is preferred. But if it's a supplier UCSB will regularly do business with and will accept a purchase order, please ask us to add them to the Walk-In Form: purchasing@bfs.ucsb.edu

Best practice is to use the FlexCard if you have an online order, or if you're only going to buy once or twice from a supplier. The process to add a supplier into Gateway can be lengthy, so the use of the FlexCard is the most expedient way to purchase in this case.

The University's default and preferred payment terms is Net 30. Please do not negotiate payment terms with the supplier, as the payment terms are set to default in our payment system, Peoplesoft. Any questions about this can be directed to purchasing@bfs.ucsb.edu