There are five ways to acquire Inventorial Equipment at the University:

-

Purchase Order

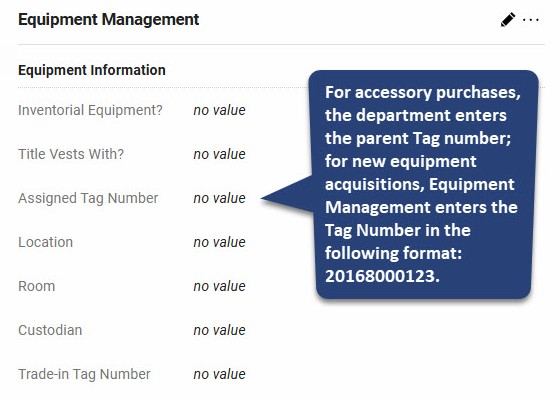

Purchase Orders are initiated via the UCSB Procurement Gateway. If you're unsure whether the equipment you are about to buy qualifies as inventorial equipment, please don't hesitate to contact us. We'll be happy to help determine if it's indeed inventorial equipment. When creating a requisition, provide all required information in the Equipment Management section of the form:

NOTE: Accessory item(s) add a component(s) to an existing asset, upgrading or extending its functionality. It has to be over $5000. Repair or replacement items do NOT count as accessory items.

-

Equipment Inventory Modification Request

EIMRs are used to record the acquisition of equipment in these situations:

-

Equipment Brought to UCSB by a New Faculty Member from another UC

-

Interdepartmental Loans and Intercampus Loans(between UC campuses)

-

-

Recovered or Found Equipment

Found - applies to equipment found during a physical inventory for which there appears not to have been any previous record.

Recovered - applies to found equipment which had previously been reported as lost or stolen or otherwise retired from inventory.Please submit a General Help ticket at this link:

https://ucsb.service-now.com/procurement?id=proc_sc_category&sys_id=1f246ebadb41a4d0a090fb051d9619f2 -

Gift Form

When inventorial equipment is donated to the University, it is almost always recorded on a Gift Form (UDEV 100-8).

For more information about Gifts to the University, visit https://bfs.ucsb.edu/extramural-funds/gifts.NOTE: Occasionally, a "gift" may be recorded on a Purchase Order, as part of a "buy one-get one free" type of situation, as a promotional item, or as an item provided at no cost by the vendor as part of a high-value order. This type of "gift" does not require processing of a UDEV form.

-

Fabrications

A Fabrication is "an item of non-expendable, tangible personal property that: (1) has been physically constructed by a University activity; (2) has a total acquisition cost of $5,000 or more; (3) has a normal life expectancy of more than one year; and (4) is expected to be used by the University upon completion. A product resulting from the simple assembly or connecting of various parts does not qualify as a fabrication."

NOTE: Consult with Equipment Management if you have any doubts before beginning a fabrication. You must obtain a Fabrication ID Number (not the same as an Asset Number) before you start making purchases for the fabrication. To get a new Fabrication ID Number, visit https://ucsb.service-now.com/esc?id=emp_taxonomy_topic&topic_id=70bfd0731bb1e610b9a96465604bcb23

Equipment Management Help Desk

If you have any questions or need further assistance, please use our ServiceNow for Payment Services portal.