If you or your parents pay for your UC tuition and fees, you may be able to offset the costs of school through federal tax credits.

The information provided at the link below is NOT tax advice. It is offered only as general information for UCSB students and their families. Please consult a qualified tax expert for advice on computing, claiming, or determining qualification for any tax benefit mentioned in this web site.

IRS publication on Education Credits--AOTC and LLC

Accessing Your 1098T Tax Form

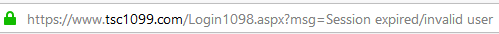

Visit the Tab Service (TCS) student site. Make sure you verify the address in your browser (you're entering personal information on this site) is as shown in this image:

Log in to the system and enter the following information:

- Enter the Site ID: 11561

- Username: Student Perm number

- Password: Last 4 digits of student SSN

- You will then be requested to change your password. Your current password at that point is still the last 4 digits of student SSN. If you logged in previously, use the password you last changed it to.

- If you have forgotten your password, click the Forgot Password Link and follow the instructions.

- You will be able to print the form by selecting "View My 1098-T Tax Form" and choosing print.

- Select the tax year of interest from the drop-down menu box. You may search for your 1098-T form for the current tax year (the default selection), as well as for the previous two tax years.

- After retrieving your 1098-T online, you may print as many duplicate copies as desired. Note that you are not required to submit any copy of the 1098-T with your tax return.

1098-E Tax Form

The Loan Servicer reports the amount of interest you paid on student loans in a calendar year. The Loan servicer sends a 1098-E to the address in their system for anyone who pays at least $600 in student loan interest. For more information visit https://studentaid.gov/help-center/answers/article/how-can-i-get-my-1098e-form